“Discomfort is often the toll that must be paid to achieve fulfillment. The reward that’s waiting for you on the other side of this hard stretch is worth the price of getting there.” — Colin O’Brady, co-founder of 29029 Everesting and author of The 12 Hour Walk1

I recently climbed the equivalent of Mount Everest. Traveling to Everest itself was an unattainable feat. Who watches the kids for two months? Would I still have a job when I got back? Would I even make it back? Too risky for me. But without the need to acclimate to elevation, battle frigid weather or to fly to Nepal, competing in 29029 Everesting was just the adventure I was willing to take. On a whim, I signed up to join a group of 290 adventurers in Utah to climb Snowbasin ski hill 13 times within 36 hours to ascend 29,029 vertical feet. This was going to be a challenge to take me out of my comfort zone. No more hesitating to take action out of fear of failure.

Risks Are Omnipresent

Upon arriving at the mountain, my wife and I were greeted by Jessie Itzler, co-founder of 29029 Everesting. After signing up for the mission, I read his book Living with a Seal.2 I knew I was talking to a self-made billionaire who had pushed his mind and body to complete some incredibly difficult ultra events. Our conversation turned to the toughest physical feat that we had ever completed. My wife’s reply: “I ran a marathon under four hours.” His response: “Multiply that by seven and that will give you an idea of how difficult 29029 will be tomorrow.” Wait what? I hadn’t even completed a single marathon! At that point, I knew I was going to test my mettle and that there was no turning back. I better just accept that I was going to encounter risks along the way—bring on the blisters, dehydration, exhaustion and twisted ankles. If you think of investing, risks are omnipresent, too. Just check out this list of risks the Oakmark Funds have encountered since 1991. This is why we fill out a risk tolerance questionnaire: to determine our asset allocation plan.

Assessing Risk

Walking up the wrong way on a ski hill was bound to be steep. For 20 weeks we had maxed out our treadmills at 20 degrees to prepare—and even that made my heart rate shoot through the roof. As we got to the starting line at 5:30 a.m., it was fortuitous that our initial ascent would be in the dark since the darkness kept us focused. We surged up the mountain one step at a time while looking straight ahead at the three-foot area around our feet that was lit by our headlamps. To our surprise, another dozen ascents appeared behind the first and the angle of ascent never once flattened. Regardless, I was feeling great after three trips up. All that training must have done the trick. But after the fourth ascent, I had burned more than 4,000 calories. My energy started to deplete and doubt seeped into my mind. I had to go up this unrelenting mountain nine more times? Are you kidding me?

However, each time we reached the Snowbasin Summit, we were given a gift—a gondola ride down. During these 15 minutes of rest, we took in the treacherous landscape from high above the trail. This zoomed-out perspective revealed all the risks that we encountered on the way up. It definitely didn’t feel this risky from ground level. The slippery rocks, the dive-bombing grasshoppers, the 80-degree sloped portions and no shade in 86-degree heat all lay before us. The gondola perch was akin to looking at the stock market with a top-down perspective. Today, investors face a cacophony of risks: inflation, war, European energy crisis, recession, rising interest rates, bear market—and all at once.

At Oakmark, we assess the macro impact on the microeconomics one business at a time. It’s the headlamp perspective, not the gondola view, if you will. Whether it be a pandemic, tsunami or recession, our analysts remain laser focused on the impact to the cash flow generation ability of the company. After all, the present value of a business is the sum of all future free cash flows. Studying our analysts’ models over time reveals that only 15% of a business’s value resides within the next three years. This means that 85% of the value of a business falls well outside of the risks that investors are fretting about today. As always, we believe today’s worries rarely significantly change the intrinsic value of the entire business. And importantly, when pessimism is abound, downside risk seems to be the only thing being talked about by the financial press and stock market strategists. We think it is impossible to time the market, but it is important to rebalance toward your asset allocation. Remember the risk we accept in investing in equities will eventually compensate us with a return. When studying similar bouts with bear markets, recessions and inflation over the last 77 years, the past reveals returns over the next two years are far superior to a random two-year period (+17%) during that time.

| Risk | Frequency | Two-Year S&P 500 Total Return |

|---|---|---|

| Bear Market | 11 | 33% |

| Recession | 12 | 25% |

| Inflation >8% | 5 | 17% |

Dealing with Risk

On the mountain, Itzler recommended to think in digestible bites—our minds can handle that and not get too overwhelmed. Hiking until the mile marker and then to the next rest stop kept my mind working toward an achievable task. Once I summited, it was critical for me to avoid the temptation to seek comfort in my tent or visit the recovery station. I just had to get right back on the mountain to keep my body moving toward the ultimate goal. Avoiding unnecessary downtime was going to keep me on pace to reach my summit. When facing today’s risks, it might be tempting to get out of the market and avoid those perils. Remember, you have an asset allocation that assumes your own risk tolerance. The point of investing isn’t to avoid all of it. Stick to your plan to help reduce the biggest risk of all: failing to meet your investment goals.

Itzler said if you expect the pain, then you will be prepared when it finally arrives. Know that your Oakmark investment team relishes today’s challenges and analysts are producing new idea memos at a quickened pace. You might not be surprised to learn that our U.S. Director of Research Alex Fitch was the first to successfully reach a 29029 Summit back in 2021. We’ve set up a culture of challenge to explore the risks of an investment thesis at our Stock Selection Group. We assign a Devil’s Advocate to every new buy idea to ensure we have explored the bear case on the stock before we risk a dollar of our clients’ money. We also have regular debates on ideas that have already been approved that pit a Devil’s Advocate versus a stock’s angel to respectfully debate the risks. We expect risks to materialize so we find methods to value them, so we can leap into action when investors get overly pessimistic or overly euphoric. Traders might flee, but well-prepared investors can exploit the margin of safety. In this way, volatility is opportunity.

As expected, my breaking point arrived during ascent number 10. After 18 hours of hiking, we had emptied our tanks and swelling made it nearly impossible to bend our legs. It was time to take a break. We limped to our tent and rested for a handful of hours on the expert advice of the 29029 coaches. Our minds then jumped to a new fear. Would we be able to get out of the cot or would we be too stiff to resume? Our coaches wisely told us not to worry—they had seen this hundreds of times before. As the sun rose on our second day, they were proven right. With grit and determination, we completed those last three ascents and reached our Everest with more than five hours to spare. The exhilaration I felt at pushing myself beyond my comfort zone remains with me weeks after the Summit. I expect the 31 hours on the mountain to provide a return on my experience for my next 14,000 days, assuming I get to live another 40 years!

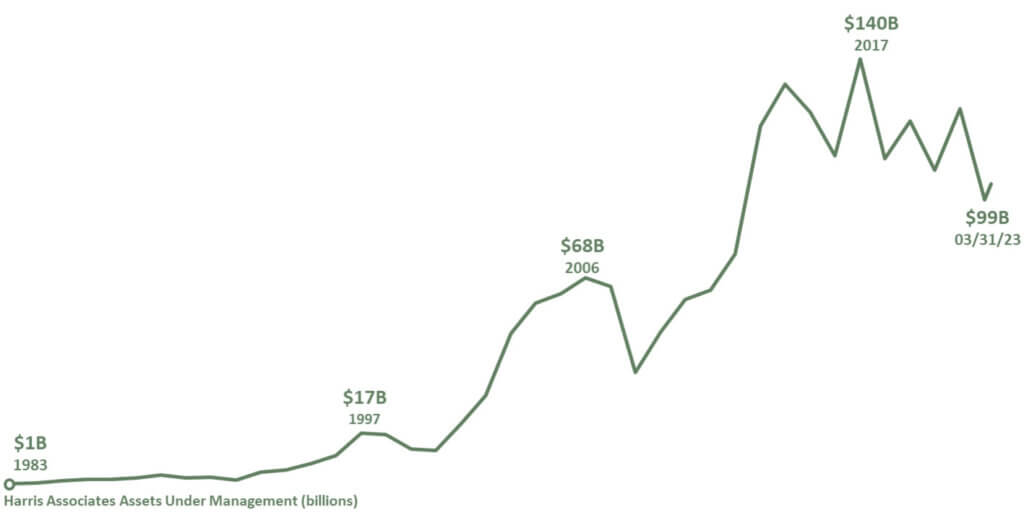

In closing, you often see our growth of $10,000 charts in our quarterly fact sheets and on our website. The growth in the assets entrusted to us takes a similar path. The slope of these charts reminds me of my Everest ascent.

Harris Associates Assets Under Management as of 03/31/2023

Sticking to our singular plan, value investing has led to significant capital compounding over time. Hindsight is 20/20, but there were significant macro risks causing investor consternation every step of the way. Your coaches are urging you to stay on the mountain—reaching your goals will be worth it.

1O’Brady, Colin. The 12-Hour Walk. New York, Scribner, 2022.

2Itzler, Jesse. Living with a SEAL: 31 Days Training with the Toughest Man on the Planet. New York, Center Street, 2015.

The S&P 500 Total Return Index is a float-adjusted, capitalization-weighted index of 500 U.S. large-capitalization stocks representing all major industries. It is a widely recognized index of broad, U.S. equity market performance. Returns reflect the reinvestment of dividends. This index is unmanaged and investors cannot invest directly in this index.

Investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers’ research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice.

Certain comments herein are based on current expectations and are considered “forward-looking statements”. These forward looking statements reflect assumptions and analyses made by the portfolio managers and Harris Associates L.P. based on their experience and perception of historical trends, current conditions, expected future developments, and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may prove to be different from expectations. Readers are cautioned not to place undue reliance on the forward-looking statements.

The discussion of investments and investment strategy of the Funds (including current investment themes, the portfolio manager’s research and investment process and portfolio characteristics) represents the investments of the Funds and the views of the portfolio managers and Harris Associates L.P., the Fund’s investment adviser, at the time of this call, and are subject to change without notice.

Daniel A. Nicholas, CFA

Marketing/Client Relations